The Proven Step-by-Step System to Finally Pay Off Your Student Loans Without Confusion, Shame, or Financial Burnout

You’ve carried your student loans long enough.

It’s time for a clear plan out.

Student Loan Exit Plan (SLEP) is a practical, faith-based course that teaches you exactly how federal student loans work and how to eliminate them with confidence, integrity, and peace.

If you are ready to be done with debt, not by avoidance or deferment, this is your roadmap.

Student Loan Exit Plan provides:

Clarity on how student loans actually work (finally).

A strategy tailored to your situation—not generic internet advice.

A plan you can follow today, even if you feel overwhelmed or behind.

The confidence to take action, backed by real math and real results.

A mindset shift that helps you steward your finances well and stay motivated.

This is not theory. It’s not guilt. It’s a step-by-step exit plan based on real numbers, real methods, and real freedom.

A Message from Lisa

Who this course is for:

You want to pay off your student loans—not avoid them.

You feel overwhelmed, confused, or frustrated by the system.

You’re tired of “hoping it works itself out” or trusting random TikTok advice.

You’re ready to understand your loan type, terms, and best payoff pathway.

You want a clear plan that fits your income, season of life, and goals.

You’d love to feel proud, empowered, and financially in control.

Who this course is not for:

You don’t want to pay off your loans.

You are only looking for deferment, forbearance, or “loopholes.”

You want a magic fix, shortcuts, or unrealistic overnight hacks.

You’re not ready to take action, even small steps.

This is for people who want to finish their loans, not freeze them.

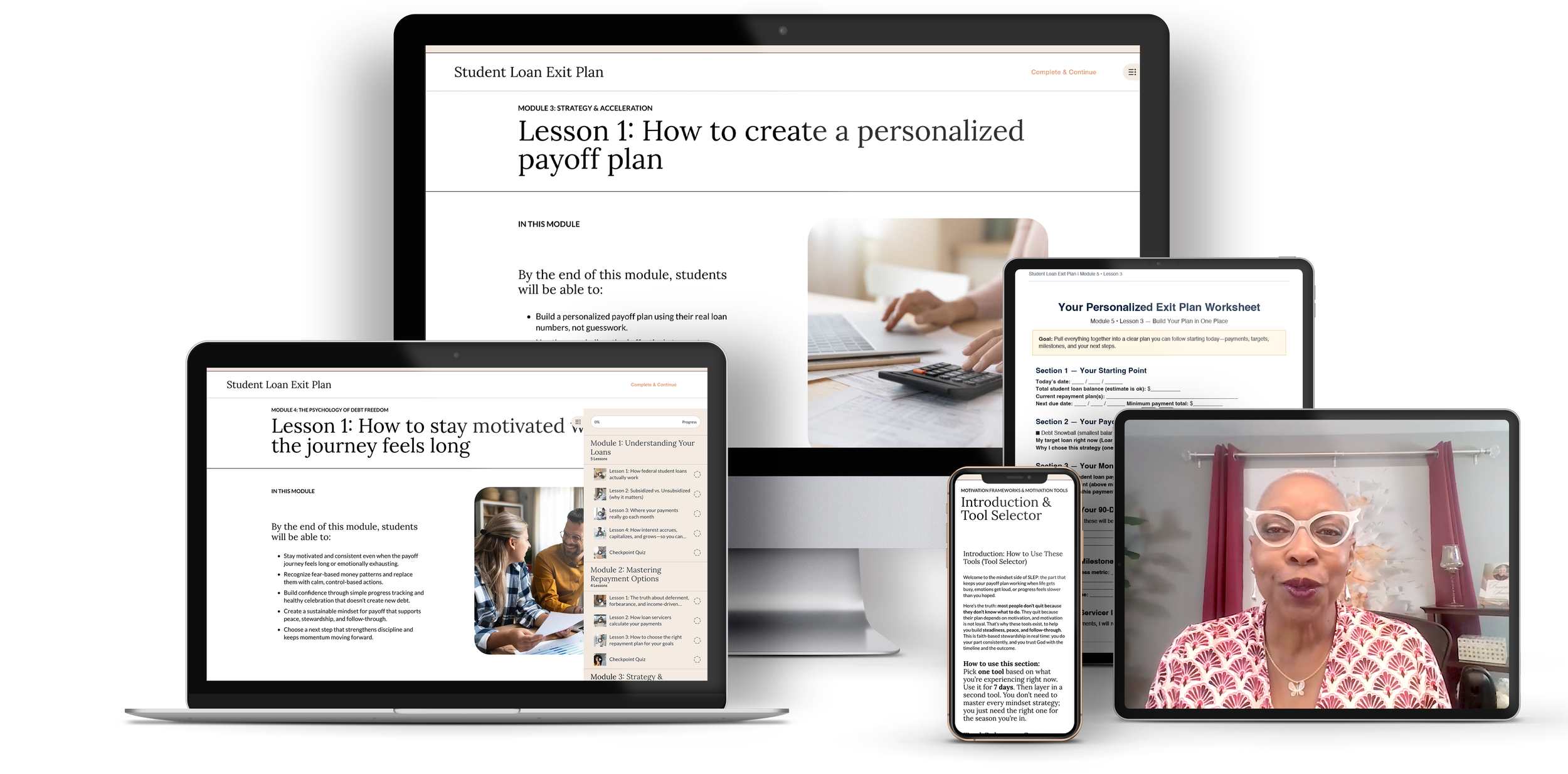

What’s Inside the Student Loan Exit Plan

A practical, step-by-step course built around real-life strategy, math, and clarity.

Module 1 — Understanding Your Loans

How federal student loans actually work (in plain English).

Subsidized vs unsubsidized: why it matters.

Where your payments really go each month.

How interest accrues, capitalizes, and grows—so you can stop the bleeding.

Module 2 — Mastering Repayment Options

The truth about deferment, forbearance, and income-driven repayment.

How loan servicers calculate your payments.

How to choose the right repayment plan for your goals.

Module 3 — Strategy & Acceleration

How to create a personalized payoff plan.

How to snowball your loans effectively.

How to eliminate loans faster with small, strategic adjustments.

When consolidation makes sense (and when it’s a terrible idea).

Module 4 — The Psychology of Debt Freedom

How to stay motivated when the journey feels long.

How to shift from fear to control.

How to celebrate progress and build financial confidence.

Module 5 — Your Personalized Exit Roadmap

A clear, customized plan you can follow starting today.

Monthly milestones and progress points.

Tools, trackers, and scripts to stay consistent and encouraged.

What you get:

Full course access

The “Know Your Loans” Audit (every detail you need in one place)

The Loan Snowball Tool

Your Personalized Exit Plan Worksheet

Scripts + Email Templates (for contacting servicers clearly + confidently)

Motivation Frameworks & Mindset Tools

Lifetime access to all updates and future enhancements inside of our Policy Watch portal

Everything is designed to be easy, digestible, and doable, even if numbers aren’t your thing.

Meet Your Instructor

Hi friend!

If we haven’t met yet, I’m Lisa Y. Jones, founder of Financially Awakened and someone who has walked the long, exhausting road of student loan debt myself.

For years, my husband Keith and I were high-earning professionals with even higher debt. Student loans. IRS payments. Credit cards. Medical bills. If it existed, we owed it.

Before we were financial coaches, we were just like many of our clients: ambitious professionals with impressive incomes and even more impressive debt.

We know firsthand that debt can feel like walking through quicksand. Every step forward seems impossible, and traditional financial advice often misses the deeper story.

That's why we created something different through our work at Financially Awakened.

You see, when we finally learned how federal student loans actually work—how interest accrues, how payments apply, how strategies like snowball and accelerated payoff really operate—everything changed. We created a system, worked the plan, and paid off $300,000 in five years.

This course is based on that system. Clear, compassionate, and honest. No shame. No shortcuts. No avoidance.

If you are ready to stop feeling stuck and start taking control, I’d love to help you do exactly what we did.

Let’s get you free.

Core

$247

5 online training modules

The “Know Your Loans” Audit (every detail you need in one place)

The Loan Snowball Tool

Your Personalized Exit Plan Worksheet

Scripts + Email Templates (for contacting servicers clearly + confidently)

Motivation Frameworks & Mindset Tools

Lifetime access to all updates and future enhancements inside of our Policy Watch portal

FAST-ACTION BONUS: Debt Action Plan

SLEP + Plan Review

$399

If you want a clear payoff plan that fits your real life, add a Plan Review with Lisa.

In this live Zoom session, Lisa will help you:

Review your current loan status and repayment setup

Identify the highest-impact payoff strategy

Avoid common mistakes that keep borrowers stuck

Map your next 90 days so you can gain traction fast

Value: $350

Includes the Core Student Loan Exit Plan plus the online Plan Review with Lisa.

Churches, 501(c)(3) organizations, and community groups: contact Lisa to ask about group pricing, church/organizational discounts, licensing options, and facilitator/teaching materials for using SLEP with your members or staff.

FAST ACTION BONUS!

FAST ACTION BONUS!

FREE Bonus (Value: $700):

Debt Action Plan

Debt steals peace, especially when student loans are only one piece of the puzzle. That’s why enrollment in Student Loan Exit Plan includes access to the Debt Action Plan, a step-by-step system that helps you eliminate debt faster without increasing your monthly budget.

You’ll start by watching a short webinar, then you’ll book a discovery session with Lisa. Together, you’ll map out a clear payoff path so you can see when you’ll be debt-free, how much money you’ll save, and what it will take to follow through without confusion, shame, or overwhelm.

Delivered via email after purchase so you can get started right away.

This bonus is reserved for fast-action takers: enroll in Student Loan Exit Plan by April 15, 2026 to receive the Debt Action Plan as an added gift to help you start eliminating debt right away.

FAQs

Is this course affiliated with the U.S. Department of Education or loan servicers?

No. This is an independent educational program provided by Financially Awakened LLC.

Do I need to be “good with numbers”?

Not at all. Lisa explains everything in plain English—no jargon, no overwhelm.

Will this course help me avoid paying my debt?

No. This is for people who want to pay off their student loans, not pause or delay them.

Does the course work if I’m on an income-driven repayment plan?

Yes. SLEP helps you understand if IDR supports your goals—or slows them. You’ll get clarity either way.

Can this help if I’m in default?

Yes, the course explains your options and pathways to get back on track safely and strategically.

How long will I have access?

You get lifetime access. Revisit the course anytime, especially when laws, income, or life changes.

What is the refund policy?

Due to the digital nature of the course, all sales are final.

What if I feel overwhelmed?

That’s exactly why SLEP exists. The entire system is designed to remove overwhelm and replace it with clarity and confidence.

Checkout

A practical, step-by-step course built around real-life strategy, math, and clarity.

Everything in Core PLUS a Plan Review with Lisa. In this live Zoom session, Lisa will help you: Review your current loan status and repayment setup Identify the highest-impact payoff strategy Avoid common mistakes that keep borrowers stuck Map your next 90 days so you can gain traction fast Value: $350

Ready to Change Your Financial Story?

Your loans don’t define you. Your past decisions don’t own you. And you are not stuck. With the right understanding and a clear plan, you can become debt-free… faster than you think.

ALL RIGHTS RESERVED © 2026 Financially Awakened, LLC