Making money but missing peace? It’s time for both

In this issue, we’ll address cash flow planning for the present and the future.

The Wealth Minute

When Do You Want To Retire?

Many people approach retirement by setting a goal to retire at a certain age.

Others believe the “perfect” time to retire is when you reach a dollar benchmark.

Both of these approaches leave out an incredibly important factor:

The cost of YOU in retirement.

Ask yourself…

• How much money do you need to meet your actual retirement expenses?

• Do you still have a mortgage or other debt?

• Do you plan to travel?

• Are you working part-time?

Take these numbers and multiply by 12 to get a year of expenses.

This becomes the baseline per year that you’ll need, without inflation or taxes being factored in.

This Kiplinger Personal Finance article explains a little more on the concept of choosing your number, not your age for retirement.

Wealth Move

Schedule a Financial Forecast appointment so we can determine EXACTLY how much you will need to retire and when it makes sense for you to plan on making your transition.

Many of my clients find that the number in their heads is very different from what they actually need.

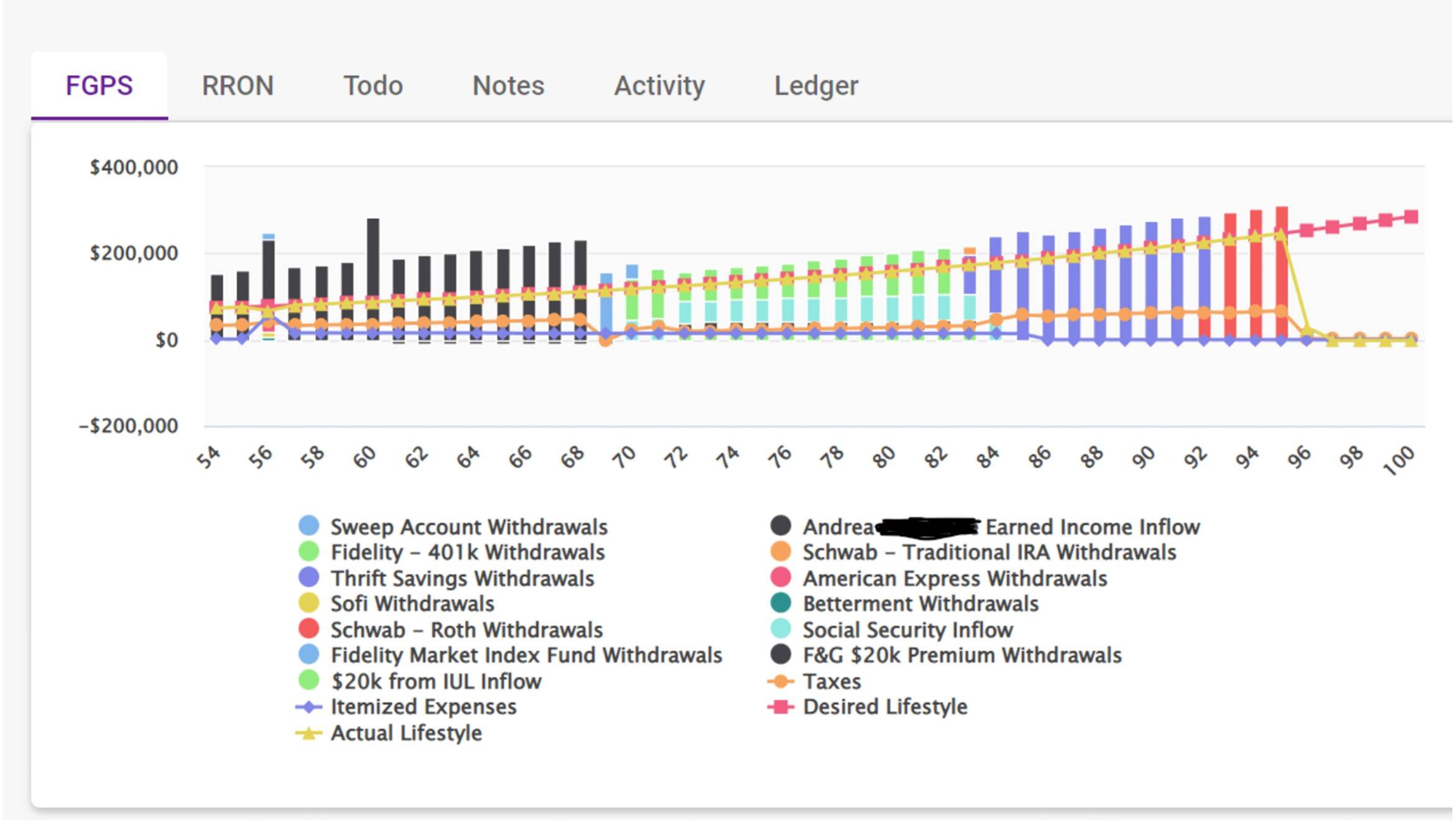

Sample Financial Forecasting Results

Knowledge is power and this appointment will empower you to be well-prepared for retirement, whenever you’re ready to transition.

The Freedom Path

Cash Flow Challenges

A pattern I see when working with clients looking to master cash flow challenges is reactionary spending.

We see something we like…swipe

We feel sad or glad or [you fill in the blank]...swipe

Others have purchased this or that and we believe we “deserve” it too…swipe

Reactionary.

Instead of REACTING to your money, why not be PROACTIVE instead?

Here’s how:

Begin by simply setting money aside to have it available when the temptation shows up.

You can use cash or transfer it to a cash card. Click here for a recommended cash envelope system.

The key is to prepare for that moment of weakness ahead of time so it doesn’t cause financial drama in other areas of your life.

I created a pdf with some other fun ideas for you to get ahead of the desire for unplanned spending.

Reach out and let me know which fits your life best.

And click here if you are ready to no longer react to your money.

My Money Mindshift Session is a great tool to help you get started.

Wealth Move

Think about your last reactionary spending moment.

What did you buy?

What was the trigger that caused the purchase?

How did the purchase make you feel?

Which of the linked tools above can you implement to prevent this type of spending in the future?

Book of The Month

The February 2025 book of the month is "Take Your Seat at the Table" by Anthony ONeal.

So many nuggets in this one. Read it with a notebook handy.

Coffee Chat Question

If we were to meet for coffee, what would you want to know?

Feel free to email me questions that will anonymously be added to this section during each edition.

“Should I get a debt consolidation loan?”

I get this question a lot.

The answer is always the same.

I do not recommend debt consolidation. You don’t actually change your debt picture when you consolidate.

Your balance doesn’t change.

It’s just lumped together instead of being separate.

On the surface, it looks as if you are spending less money…

But here’s what’s actually happening:

Your credit score will be negatively impacted by a hard credit pull. The inquiry will stay on your report for two years.

The amount of interest paid will be drastically higher because your payment per account will be lower.

The debt consolidation company is taking a fee out of your payment, which lowers the amount going to your creditors even further. This means more time to pay off the debt and more interest accrued.

You didn’t actually fix the issue that created the debt in the beginning. As many as 88% of people who get a debt consolidation loan go back into debt after it’s repaid.

Any negotiated amount that’s forgiven will be reported as income. The IRS will then calculate interest, penalties, and fees on the non-reported income, creating a tax liability.